mercedes-models.ru Community

Community

Most Liquid Inverse Etfs

It is probably safe to say that most of us have large-cap investments in our portfolios. The S&P is one of the largest and most widely followed indexes in. Typically they are still more liquid than most traditional mutual funds because they trade on exchanges. stocks, including those related to short selling and. This is a list of all Leveraged Inverse ETFs traded in the USA which are currently tagged by ETF Database. leveraged ETFs. We find that these ETFs are traded mainly by retail traders with very short holding periods. Price deviations (from NAV) are small on. Most ETFs are transparent and typically liquid and low cost. Transparent They may come from short-term mutual fund capital gains, real estate. Listed Issues - Leveraged and Inverse Products ; Apr. 12, , Nikkei Leveraged Index, , NEXT FUNDS Nikkei Leveraged Index ETF. Indicative NAV. Here are the best Trading--Inverse Equity funds · ProShares UltraShort Financials · Direxion Daily AMZN Bear 1X ETF · ProShares UltraShort S&P · Direxion Daily. These funds attempt to do the opposite of the index they track. This means for instance, if the index drops by 6, the inverse ETF will rise by 6. Almost like. When using an inverse ETF, the losses are limited to the amount that you invested into the position. When you are correct in your positioning, however—when you. It is probably safe to say that most of us have large-cap investments in our portfolios. The S&P is one of the largest and most widely followed indexes in. Typically they are still more liquid than most traditional mutual funds because they trade on exchanges. stocks, including those related to short selling and. This is a list of all Leveraged Inverse ETFs traded in the USA which are currently tagged by ETF Database. leveraged ETFs. We find that these ETFs are traded mainly by retail traders with very short holding periods. Price deviations (from NAV) are small on. Most ETFs are transparent and typically liquid and low cost. Transparent They may come from short-term mutual fund capital gains, real estate. Listed Issues - Leveraged and Inverse Products ; Apr. 12, , Nikkei Leveraged Index, , NEXT FUNDS Nikkei Leveraged Index ETF. Indicative NAV. Here are the best Trading--Inverse Equity funds · ProShares UltraShort Financials · Direxion Daily AMZN Bear 1X ETF · ProShares UltraShort S&P · Direxion Daily. These funds attempt to do the opposite of the index they track. This means for instance, if the index drops by 6, the inverse ETF will rise by 6. Almost like. When using an inverse ETF, the losses are limited to the amount that you invested into the position. When you are correct in your positioning, however—when you.

Mutual Funds Home A highly liquid secondary market may not exist for the credit default swaps the fund invests in, and there can be no assurance that a highly. 1x Short exposure to British blue chip companies listed in GBP on the London Stock Exchange; Short exposure to the largest and most liquid companies. Only seasoned traders should consider trading inverse leveraged ETFs Broad Market ETFs are the most liquid and heavily traded. Domestic index. What are leveraged and inverse ETFs? What are important considerations for investors working with financial advisers? Why do investors use ETFs? Exchange-traded. Find leveraged and inverse ETFs. Strategies: Broad Market, Sector, Crypto-Linked, International, Thematic, Fixed Income, Commodity, Currency, Daily Objective. IWM is a popular ETF with $58 billion in AUM, tracking one of the most watched small-cap benchmarks for a % expense ratio. Traded on the NYSE Arca, it's one. , NEXT FUNDS Nikkei Inverse Index ETF. Indicative NAV · Futures Type. Nomura Asset Management, 1, , ○ , NEXT FUNDS Nikkei Double Inverse. Inverse ETFs carry many risks and are not suitable for risk-averse investors. This type of ETF is best suited for sophisticated, highly risk-tolerant investors. As the most liquid ETF in the world, SPY has a well-developed options chain ETFs Charted - Leverage & Inverse ETFs Across the Atlantic. 1 de agosto. Overall, % of all retail ETF trades are in leveraged or inverse ETF. This compares to % of all trades that are in core equity ETFs. Retail investors. An inverse ETF, often known as a bear or short ETF, is an exchange-traded fund designed to profit from a market decline. These short-term, publicly traded. most traded stocks on the market. All seven aim to capitalize on What risks should I be aware of when trading single-stock leveraged & inverse ETFs? Single-stock ETFs may use leveraged and inverse strategies as they seek a multiple on investment returns for a particular frequently traded stock. Investors. most liquid domestically-traded leveraged Exchange Traded Funds (ETFs). The Leveraged ETFs: Leveraged and inverse ETFs pursue daily leveraged. Many ETFs provide some level of diversification compared to owning an individual stock. An ETF divides ownership of itself into shares that are held by. REX Shares is an innovative, award winning provider of exchange-traded products that specializes in alternative-strategy ETFs and ETNs. From plain-vanilla offerings that turned the most liquid stocks in various Thus, we get inverse ETFs, leveraged ETFs, commodity ETFs. With an. Leveraged ETFs aim to amplify the returns of an underlying index, which can lead to higher gains, but they also magnify losses in downturns. Similarly, inverse. These funds attempt to do the opposite of the index they track. This means for instance, if the index drops by 6, the inverse ETF will rise by 6. Almost like. US ETFs that have been traded the most ; QQQ · D · B USD, USD ; SPY · D · B USD, USD ; TQQQ · D · B USD, USD ; IWM · D · B USD.

Places That Cash Checks 24 Hours

With PLS, it's convenient to cash checks, send money and pay your bills. Visit us at one of our locations to get the ease and service you deserve. TA, Petro and TA Express locations will accept checks from billing companies and NATSO approved accounts up to a total of $ in 24 hours. A service fee. 11 Locations throughout the Bronx and Harlem - Some Open 24 Hours! | As of We cash most types of checks – payroll checks, income tax refund checks. Stop at less than 3K in 24 hours. THEN go in the next day. Do the Woooow that is so crazy that check cashing places wouldn't even allow you. Why would they put that there open 24 hours and there NOT? LAIRS Places Near Perth Amboy with Check Cashing Service. Staten. South Broad Street Philadelphia, PA Contact Phone: () Fax: () Hours, Products and Services. Store Hours: Mon. Open 24 Hours. Rockaway Blvd. CFSC Checks Cashed Mother Gaston. Closed Cash your tax refund checks at your nearest CFSC locations. Bank ATMs With Hour Check Cashing · 1. Bank of America · 2. Capital One · 3. Chase · 4. Citibank · 5. Citizens Bank. Hour Check Cashing Near Me: 6 Places To Cash Checks After Hours · Payomatic. Payomatic is a chain of check-cashing stores in New York City. · PLS 24/7. PLS. With PLS, it's convenient to cash checks, send money and pay your bills. Visit us at one of our locations to get the ease and service you deserve. TA, Petro and TA Express locations will accept checks from billing companies and NATSO approved accounts up to a total of $ in 24 hours. A service fee. 11 Locations throughout the Bronx and Harlem - Some Open 24 Hours! | As of We cash most types of checks – payroll checks, income tax refund checks. Stop at less than 3K in 24 hours. THEN go in the next day. Do the Woooow that is so crazy that check cashing places wouldn't even allow you. Why would they put that there open 24 hours and there NOT? LAIRS Places Near Perth Amboy with Check Cashing Service. Staten. South Broad Street Philadelphia, PA Contact Phone: () Fax: () Hours, Products and Services. Store Hours: Mon. Open 24 Hours. Rockaway Blvd. CFSC Checks Cashed Mother Gaston. Closed Cash your tax refund checks at your nearest CFSC locations. Bank ATMs With Hour Check Cashing · 1. Bank of America · 2. Capital One · 3. Chase · 4. Citibank · 5. Citizens Bank. Hour Check Cashing Near Me: 6 Places To Cash Checks After Hours · Payomatic. Payomatic is a chain of check-cashing stores in New York City. · PLS 24/7. PLS.

All checks subject to review for approval. Fees may apply. Most credit card issuers post funds within 24 hours. Go to your nearest Speedy Cash check cashing store. 2. PROVIDE VALID ID Balance must be brought to at least $0 within 24 hours of authorization of. Need to cash a check? Cliff's cashes all types of checks, from payroll to workers comp, bring it to Cliff's! Serving North Central Texas Since Open 24 Hours. Rockaway Blvd. CFSC Checks Cashed Mother Gaston. Closed Cash your tax refund checks at your nearest CFSC locations. 1. CFSC Checks Cashed. (8 reviews) ; 2. East Broadway Check Cashing Svce. (0 reviews) ; 3. PLS checking Cashing. (7 reviews) ; 4. U Rove Check Cashing. We help people every day with payday loans, check cashing, money transfers, and other financial services. When you receive a check from an employer, government agency, or another source, you can take it to a check cashing 24 hours service. They will verify the. ACE Cash Express check cashing stores cash most check types, with longer service hours than traditional banks. We have cash on hand and competitive fees. Try us. Use our store locator to find The Check Cashing Store location near you in Florida. Balance must be brought to at least $0 within 24 hours of authorization of the first transaction that overdraws your account to avoid a fee. See app for. With over locations nationwide, CFSC Broadway provides financial services for all the essentials such as, check cashing, money orders, money transfers. Get your check cashed today! Get your cash and some snacks inside your favorite retailer. SAM Check Cashing Kiosks are conveniently located inside retail. Locations & Hours · Los Angeles County · 3rd Also, our store at University Ave in San Diego is the only 24 hour check cashing business in the county. When you receive a check from an employer, government agency, or another source, you can take it to a check cashing 24 hours service. They will verify the. Use our store locator to find your closest Kroger Money Services Desk. With more than 2, locations available, a Money Services Desk is always conveniently. Regions offers check cashing services — including handwritten, out-of-state, insurance, two-party, tax refunds, business, government and payroll — so you can. The answer is no. The only time you can have a checked cash is when the customer service desk is open. Hours vary from store to store. Check. 11 Locations throughout the Bronx and Harlem - Some Open 24 Hours! | As of We cash most types of checks – payroll checks, income tax refund checks. Check Into Cash is your #1 Check Cashing center. From tax refunds to payroll checks, we can turn your checks into cash quickly and easily. Get more information for 24 Hour Check Cashing in Kansas City, MO. See reviews, map, get the address, and find directions.

Dealer Warrenty

In Massachusetts, a dealer is defined as someone who sells more than 3 cars in a month period, even if they do not have a valid used car dealer license. Easycare Drivers Benefits, Vehicle Service Contracts,VSC, gap insurers, Paintless Dent Repair, Tire & Wheel, extended car warranty, RV Warranties. This law requires a dealer to give you a written warranty. Under this warranty, the dealer must repair any defect in covered parts, with no cost to you. Our dealership is proud to provide a Lifetime Limited Powertrain Warranty on our vehicles at no additional cost. Always have your dealer put in writing what's included in your extended warranty — and what the cost of the repairs will be without one — before you move. New Vehicle Protection Plans are available for vehicles still covered under the manufacturer's basic factory warranty. These plans provide extended coverage. An auto warranty is a promise to fix certain defects or malfunctions during a specific timeframe after you buy a vehicle. The powertrain warranty lasts for 10 years or up to , miles and will replace or repair specific transmission, engine, and drive system parts. For the. Our F&I program provides dealerships with the best solutions to create the ultimate customer satisfaction experience—tailored to each individual driver's needs. In Massachusetts, a dealer is defined as someone who sells more than 3 cars in a month period, even if they do not have a valid used car dealer license. Easycare Drivers Benefits, Vehicle Service Contracts,VSC, gap insurers, Paintless Dent Repair, Tire & Wheel, extended car warranty, RV Warranties. This law requires a dealer to give you a written warranty. Under this warranty, the dealer must repair any defect in covered parts, with no cost to you. Our dealership is proud to provide a Lifetime Limited Powertrain Warranty on our vehicles at no additional cost. Always have your dealer put in writing what's included in your extended warranty — and what the cost of the repairs will be without one — before you move. New Vehicle Protection Plans are available for vehicles still covered under the manufacturer's basic factory warranty. These plans provide extended coverage. An auto warranty is a promise to fix certain defects or malfunctions during a specific timeframe after you buy a vehicle. The powertrain warranty lasts for 10 years or up to , miles and will replace or repair specific transmission, engine, and drive system parts. For the. Our F&I program provides dealerships with the best solutions to create the ultimate customer satisfaction experience—tailored to each individual driver's needs.

extended warranty or service contract, and the cost of motor vehicle insurance. *Note: Any motor vehicle dealer who finances the sale of a vehicle under a. New Vehicle Protection Plans are available for vehicles still covered under the manufacturer's basic factory warranty. These plans provide extended coverage. Hero 1. PWI Dealer Signup Button. PWI WEB Hero 1 Title. PWI offers a wide range of vehicle service contracts to cover any vehicle on any budget. · Hero 2. Contact Us · () DGW · EMAIL US · START CANCELLATION. Dealer General. The Industry Leader in Retail Warranty Reimbursement · Endorsed by 24 State Automobile Dealer Associations · Armatus is Certified or Partners With All the Major. Peace of Mind for the Life of Your Vehicle. At no extra cost to you, Cleveland Ford offers Lifetime Warranty, a non-factory, limited powertrain service warranty. We're one of the only dealerships in the Greater Cincinnati area that offers a Free Lifetime Mechanical Warranty on all vehicles purchased at our dealership. Since , GWC Warranty has invested in dealers who sell used vehicles by providing F&I solutions that bring long-lasting value to our partners and their. Our Products · Vehicle Service Contracts · GAP Contracts · Tire & Wheel Contracts · Collection Products · Limited Warranty Products · Theft Deterrent Products. Buick Warranty and Protection Plans · Bumper-to-Bumper and Powertrain · Thousands of Dealers to handle repairs · Techs trained specifically on your vehicle · Fully. How Long Does a Car Warranty Last? Car warranties operate for a set period or distance in miles. The typical auto warranty coverage is three years/36, miles. leading reviews. Million+. paid in claims. 1,+. dealer participants. DOWC® Runs on Transparency. Excellent online reviews (Google & BBB). Rainald M. 4. If you have a warranty, is it necessary for all new or used vehicle service to be performed at the dealership or can you go elsewhere? Learn more. Buick Warranty and Protection Plans · Bumper-to-Bumper and Powertrain · Thousands of Dealers to handle repairs · Techs trained specifically on your vehicle · Fully. A “dealer” is defined under the law as a business or individual who has sold more than three vehicles in the preceding 12 months. Under the law, you must. With a limited warranty from Chevrolet, you can drive confidently knowing your new vehicle is backed with outstanding service and coverage. See dealer or. Endurance Dealer Services (EDS), the premier provider of auto-related F&I Warranty with Exclusionary 10/ Wrap coverage, ValueMax Complete with. "You have to complete repairs and maintenance on your vehicle at the selling dealer." Here are the facts: Our Lifetime Limited Powertrain Warranty covers the. This guide will help you understand sales practices and warranty options in the pre-owned vehicle market. A “dealer” is defined under the law as a business or individual who has sold more than three vehicles in the preceding 12 months. Under the law, you must.

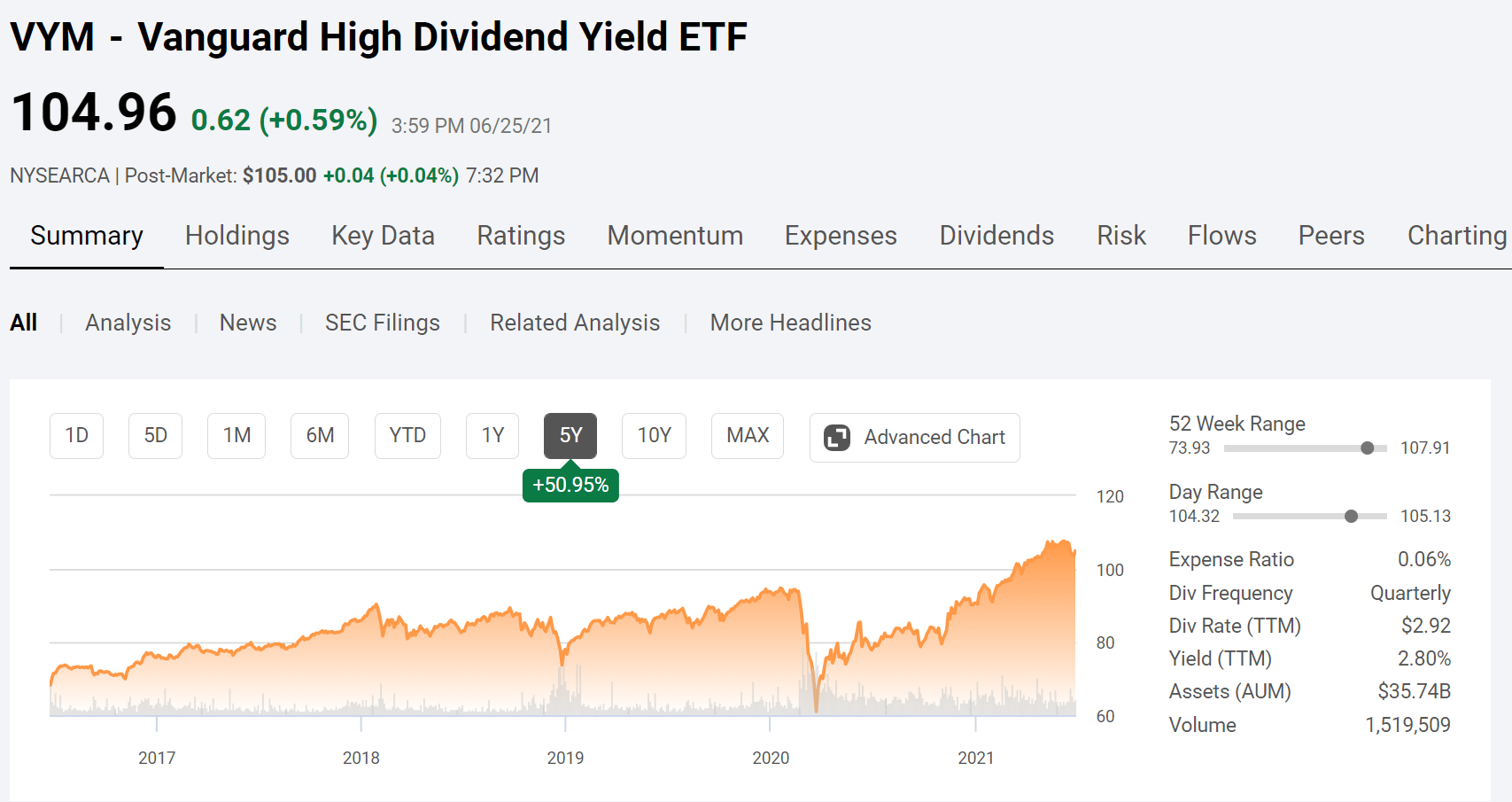

Vanguard Advice Select Dividend Growth

The Fund will invest predominantly in dividend-paying large-cap stocks that offer the potential for attractive dividend and earnings growth over the long term. Vanguard Advice Select Dividend Gr Admrl has a trailing dividend yield of %, which is above the % category average. The fund normally distributes its. The investment seeks to provide, primarily, a growing stream of income over time and, secondarily, long-term capital appreciation and current income. VADGX - Vanguard Advice Select Dividend Growth Fund Admiral Shares has disclosed 28 total holdings in their latest SEC filings. Most recent portfolio value. VANGUARD GLOBAL MINIMUM VOLATILITY FUND-Investor Shares VMVFX. - VYM. VANGUARD HIGH DIVIDEND YIELD INDEX FUND-Admiral Shares VHYAX. VANGUARD MID-CAP GROWTH. Vanguard Advice Select Dividend Growth Fund. ―. Price Change: ―. Analysis · Analyst Forecasts · Holdings · Dividends · Technical Analysis · Similar Mutual Funds. The Fund invests in stocks that offers dividends. It focuses on companies that have prospects for long-term returns for their ability to grow earnings. Get Vanguard Advice Select Dividend Growth Fund Admiral Shares (VADGX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Vanguard Advice Select International Growth Fund seeks to provide long-term capital appreciation. In selecting stocks, Baillie Gifford, advisor to the fund. The Fund will invest predominantly in dividend-paying large-cap stocks that offer the potential for attractive dividend and earnings growth over the long term. Vanguard Advice Select Dividend Gr Admrl has a trailing dividend yield of %, which is above the % category average. The fund normally distributes its. The investment seeks to provide, primarily, a growing stream of income over time and, secondarily, long-term capital appreciation and current income. VADGX - Vanguard Advice Select Dividend Growth Fund Admiral Shares has disclosed 28 total holdings in their latest SEC filings. Most recent portfolio value. VANGUARD GLOBAL MINIMUM VOLATILITY FUND-Investor Shares VMVFX. - VYM. VANGUARD HIGH DIVIDEND YIELD INDEX FUND-Admiral Shares VHYAX. VANGUARD MID-CAP GROWTH. Vanguard Advice Select Dividend Growth Fund. ―. Price Change: ―. Analysis · Analyst Forecasts · Holdings · Dividends · Technical Analysis · Similar Mutual Funds. The Fund invests in stocks that offers dividends. It focuses on companies that have prospects for long-term returns for their ability to grow earnings. Get Vanguard Advice Select Dividend Growth Fund Admiral Shares (VADGX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Vanguard Advice Select International Growth Fund seeks to provide long-term capital appreciation. In selecting stocks, Baillie Gifford, advisor to the fund.

Performance charts for Vanguard Advice Select Dividend Growth Fund (VADGX) including intraday, historical and comparison charts, technical analysis and. Vanguard Advice Select Dividend Growth Fund (VADGX) Forecast and Price Targets - Get a free in-depth forecast of VADGX. Analyze the Fund Vanguard Dividend Growth Fund Investor Shares having Symbol VDIGX for type mutual-funds and perform research on other mutual funds. Vanguard Advice Select Dividend Growth Fund had a return of % year-to-date (YTD) and % in the last 12 months. The fund invests primarily in stocks that tend to offer current dividends. Under normal circumstances, the fund will invest at least 80% of its assets in. VAIGX's dividend yield, history, payout ratio & much more! mercedes-models.ru: The #1 Source For Dividend Investing. The fund has returned percent over the past year. Hypothetical Growth of $10, Get the latest Vanguard Advice Select Dividend Growth Fund Admiral Shares (VADGX) real-time quote, historical performance, charts, and other financial. Vanguard Advice Select Dividend Growth Fnd. Portfolio Analysis. FinanceMap's portfolio analysis is based on the Paris Agreement Capital Transition Assessment. Vanguard Advice Select Dividend Growth Fund Admiral Shares Data delayed at least 15 minutes, as of Aug 12 Use our fund screener to discover other. The Fund invests primarily in stocks that tend to offer current dividends. The Fund focuses on high-quality companies that have prospects for long-term. Under normal circumstances, the fund will invest at least 80% of its assets in dividend paying securities. These securities typically—but not always—will be. Vanguard Advice Select Dividend Growth Fund (VADGX) · Performance Summary · Trust Performance and Risk Analysis (Since Inception) · Strategy Performance and. Complete Vanguard Advice Select Dividend Growth Fnd;Admiral funds overview by Barron's. View the VADGX funds market news. Vanguard Advice Select Dividend Growth Fund Admiral Shares (VADGX) dividend growth history: By month or year, chart. Dividend history includes: Declare date. Vanguard Dividend Growth Fund seeks above-average current income and long-term growth of capital and income. The advisor, Wellington. advisors, institutional investors, and Vanguard Flagship and Vanguard Personal Advisor Services clients. select investors: “Vanguard's alternative. Kilbride still contributes ideas and runs Vanguard Advice Select Dividend Growth VADGX, a more concentrated version of this strategy available to clients in. Vanguard Advice Select Global Value Fund (VAGVX) - Find objective, share price, performance, expense ratio, holding, and risk details. Vanguard Advice Select Dividend Growth Fnd;Admiral advanced mutual fund charts by MarketWatch. View VADGX mutual fund data and compare to other funds.

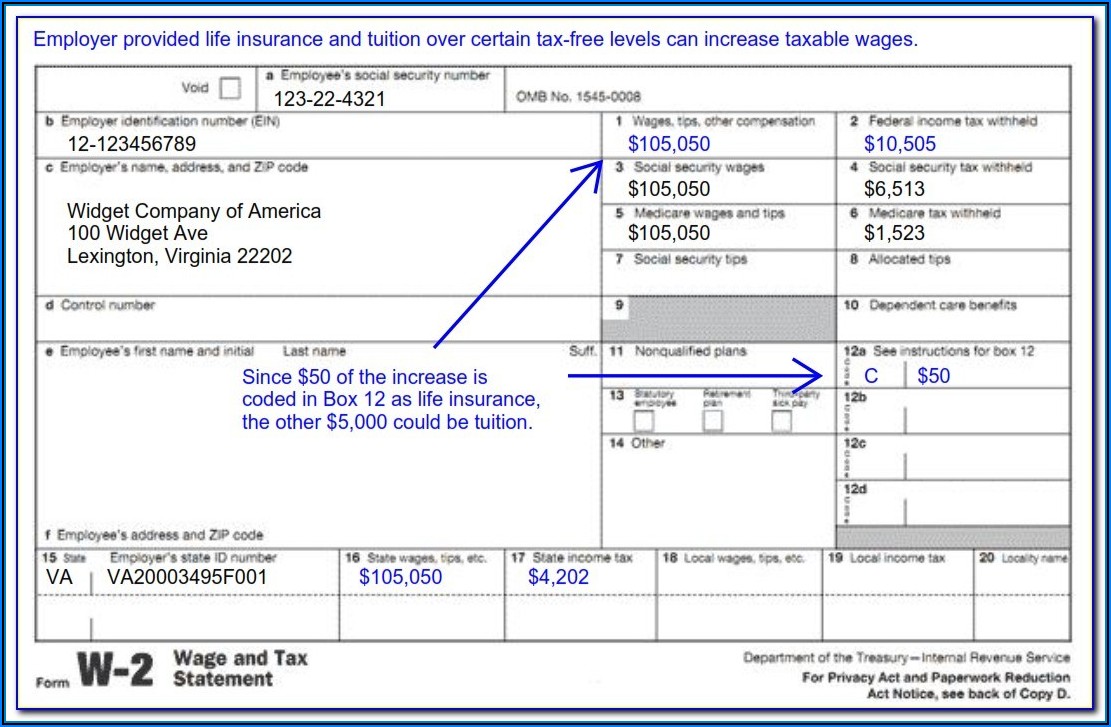

How To Retrieve Missing W2

Form W-2, Wage and Tax Statement, is prepared by your employer. If you did not receive your W-2, contact your employer. Employers are required to issue W Like asking for your pay stubs, you can get your W-2 by calling or sending an e-mail to your payroll administrator. Check if they have your mailing address. To obtain current and past W-2s online, go to HRP Web and click on Employee Inquires > W-2 Reprint > the year in question. As long as payroll was processed. Login to your NYCAPS ESS account and change your W-2 print and delivery status as illustrated below. NYCAPS Screen Step 1. This image is a description of how to. The IRS Form W-2 is issued and distributed by Payroll Services. There are two methods of distribution: online or paper copy. Employees who opt-in for W For Home Healthcare Providers duplicate W-2 requests, please call the Department of Health and Human Services (DHHS) at Employers aren't required to provide their workers with a copy of their W-2 Form until January 31, So, can someone with a missing W-2 form file a. Log in to Paychex Flex. Under Tax Documents, click the PDF icon to download your W-2 or If you haven't received your W2 form by mid-February, contact your employer to ensure they have your correct mailing address and inquire about the status of. Form W-2, Wage and Tax Statement, is prepared by your employer. If you did not receive your W-2, contact your employer. Employers are required to issue W Like asking for your pay stubs, you can get your W-2 by calling or sending an e-mail to your payroll administrator. Check if they have your mailing address. To obtain current and past W-2s online, go to HRP Web and click on Employee Inquires > W-2 Reprint > the year in question. As long as payroll was processed. Login to your NYCAPS ESS account and change your W-2 print and delivery status as illustrated below. NYCAPS Screen Step 1. This image is a description of how to. The IRS Form W-2 is issued and distributed by Payroll Services. There are two methods of distribution: online or paper copy. Employees who opt-in for W For Home Healthcare Providers duplicate W-2 requests, please call the Department of Health and Human Services (DHHS) at Employers aren't required to provide their workers with a copy of their W-2 Form until January 31, So, can someone with a missing W-2 form file a. Log in to Paychex Flex. Under Tax Documents, click the PDF icon to download your W-2 or If you haven't received your W2 form by mid-February, contact your employer to ensure they have your correct mailing address and inquire about the status of.

How do I obtain a copy of my W2? · Log in to using your user ID and password. · Scroll to the Individual Income Tax portion of the page and select “Submit a. If you lose a previous year's W-2 form and need it as proof of income you should reach out to your former employer and request a copy of the missing year's W 5. I didn't receive my W-2 from my employer. How do I get a copy. The process to consent and retrieve W-2 forms electronically is available through My ASU. Review the information below or contact Human Resources to learn more. If you have not received your W-2 by this date, or if you have lost or misplaced it, you can contact your employer. Ensure your W-2 does not get lost in the mail. Secure your personal information from possible exposure on the way to your mailbox. Take control of your W If you haven't received your Form W-2 by that date, ask your employer to reissue it. If you are unable to get a Form W-2 from your employer, attach copies. If you have not received your W-2 by this date, or if you have lost or misplaced it, you can contact your employer. The process to consent and retrieve W-2 forms electronically is available through My ASU. Review the information below or contact Human Resources to learn more. If you've separated within 13 months, you can login to your myPay account to get your W2. If you can't access your myPay account, you can submit a tax. You may contact them at , or through their website at mercedes-models.ru View additional W-2 information. There are plenty of options you can perform to obtain another copy. Depending on the circumstance, you could ask your employer for a copy or even the IRS. Whether you owe additional taxes or are due a tax refund, you should always file your tax return on time even if you have incomplete information due to missing. File a Form X On occasion, you may receive your missing W-2 after you filed your return using Form , and the information may be different from what you. If you still do not receive your W-2 by February 15th, you can contact the IRS at mercedes-models.ru or call If you misplaced your W-2, contact your employer. Your employer can replace the lost form with a “reissued statement.”. Lost Copies. Electronic copies of W-2s are available in HIP for calendar year onward. To obtain a copy of an older W Please follow these steps below to retrieve your W Log into Single Sign On using your UIN and password. Click the Workday option. Click the “Pay” Worklet. In. If your W-2 Form is not legible or if you have lost it, contact your employer and request another. If you have not received your W-2 Form, and it is after. The IRS will try to contact your employer to get the missing form for you. The IRS will also send you Form , which you can use if you do not receive.

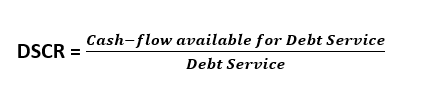

Dscr 1.2

Any debt service coverage ratio over 1 means that the debt can be covered by the income of the rental property. A ratio of or higher means that borrowers. DSCR. If the net operating income and expenses remain the For example, a lender may establish a minimum DSCR at origination of in its underwriting. A DSCR greater than is typically considered a good ratio for residential investment property. Long-Term Rental DSCR Loan Requirements*. No personal. Debt Service Coverage Ratios (DSCR). 20 are set by statutes and regulations Must not have been created with an Identity of Interest (IOI). If the DSCR is , that means the property can cover its total debt times over the current year. This is assuming that the debt obligations do not increase. The DSCR formula is straightforward: the Net Operating Income is divided by the Total Debt Service. Lenders typically look for a DSCR between and The Debt Service Coverage Ratio (DSCR) is the most widely used debt ratio within project finance. It is used to size and sculpt debt payments. DSCR to be This is traditionally considered a good enough net positive position where the borrower would still be able to meet their debt. Private lenders typically require a DSCR of or higher to make sure the income generated by the property can conservatively repay the loan. How does DSCR. Any debt service coverage ratio over 1 means that the debt can be covered by the income of the rental property. A ratio of or higher means that borrowers. DSCR. If the net operating income and expenses remain the For example, a lender may establish a minimum DSCR at origination of in its underwriting. A DSCR greater than is typically considered a good ratio for residential investment property. Long-Term Rental DSCR Loan Requirements*. No personal. Debt Service Coverage Ratios (DSCR). 20 are set by statutes and regulations Must not have been created with an Identity of Interest (IOI). If the DSCR is , that means the property can cover its total debt times over the current year. This is assuming that the debt obligations do not increase. The DSCR formula is straightforward: the Net Operating Income is divided by the Total Debt Service. Lenders typically look for a DSCR between and The Debt Service Coverage Ratio (DSCR) is the most widely used debt ratio within project finance. It is used to size and sculpt debt payments. DSCR to be This is traditionally considered a good enough net positive position where the borrower would still be able to meet their debt. Private lenders typically require a DSCR of or higher to make sure the income generated by the property can conservatively repay the loan. How does DSCR.

9 means a business has enough cash flow to pay for 90% of its expenses, while a DSCR of means it has enough income to pay for all its debt plus 20%. Debt Service Coverage Ratio. What Is the Debt-Service Coverage Rat. DSCR of less than may have difficulty making its debt payments on time. DSCR. Please note that most conventional loans require a DSCR of x or higher. DSCR = NOI / Debt Service. NOI. Loan Amount. Interest Rate. Amortization (Years). A company that has a DSCR of or higher is generally considered to have enough income to cover its debt payments, while a company with a DSCR of less than. To calculate DSCR, divide the net operating income by the total debt service. For example, if your property generates $, annually and your debt payments. For example, a DSCR slightly higher than 1 at may demonstrate that a change in cash flow could make the borrower unable to repay the loan. Additionally. Debt Service Coverage Ratio. What Is the Debt-Service Coverage Rat. DSCR of less than may have difficulty making its debt payments on time. DSCR, or Debt Service Coverage Ratio, loans are a type of financing that A DSCR of means that you have 20% more income than you need to cover. Most lenders will require a DSCR of to Which means that the property's income will cover the operating expenses and the loan repayments, with money to. The Debt Service Coverage Ratio (DSCR) is Usually lenders look for a DSCR of at least to minimize the risk that a property can't pay its mortgage. Each loan is unique and has its own DSCR minimum, but most lenders want to see a DSCR minimum of to , with a ratio of or higher being the most ideal. Lenders typically seek a DSCR of or higher, meaning that the property is generating times its debts through rental income. DSCR Loan Requirements. If. For instance, a DSCR of means that the property's income is times the amount needed to cover its debt service, indicating a healthy. The Debt Service Coverage Ratio (sometimes called DSC or DSCR) is a credit metric used to understand how easily a company's operating cash flow can cover its. DSCR. Please note that most conventional loans require a DSCR of x or higher. DSCR = NOI / Debt Service. NOI. Loan Amount. Interest Rate. Amortization (Years). If you run a SFR (single-family rental) portfolio, then you may choose a minimum DSCR closer to The reason is simple—the volume of properties means you. Increased Borrowing Capacity. Debt Service Coverage Ratio DSCR form on a table. Most lenders require a minimum DSCR of to , which signifies that the. I need to find the optimal debt size (max gearing ratio 70%) by taking into consideration the min DSCR (x). Upvote 8. Downvote 11 comments. In most instances, lenders want to see a DSCR around or higher. In other words, your income is times higher than your total debt service. A DSCR of , means that the property can cover its debt times in a given year. A DSCR of indicates that the property's net operating income exactly.

Lithium Investment Trust

As of [mercedes-models.ru_weekends]. Lithium companies can have their presence across the consumer discretionary, industrial, and materials sectors. income, domicile and replication method ranked by fund size. Compare all Global X Lithium & Battery Tech UCITS ETF USD AccumulatingIE00BLCHJN13, Lithium ETF List. Lithium ETFs hold securities that are engaged in some aspect of the lithium industry, including exploration, mining, and production of lithium. Get Global X Lithium & Battery Tech ETF (LIT:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. To achieve its investment objective, The Index is designed to provide exposure to the performance of global, publicly listed companies engaged in the mining. Global X Lithium ETF (the Fund) seeks to provide investment results that correspond generally to the price and yield performance of the Solactive Global Lithium. Learn about ETFs that provide investments in top lithium and battery technology for the electric vehicle industry. Find the latest quotes for Global X Lithium & Battery Tech ETF (LIT) as well as ETF details, charts and news at mercedes-models.ru Sprott Lithium Miners Fund (NASDAQ: LITP) seeks to provide investment results that, before fees and expenses, correspond generally to the total return. As of [mercedes-models.ru_weekends]. Lithium companies can have their presence across the consumer discretionary, industrial, and materials sectors. income, domicile and replication method ranked by fund size. Compare all Global X Lithium & Battery Tech UCITS ETF USD AccumulatingIE00BLCHJN13, Lithium ETF List. Lithium ETFs hold securities that are engaged in some aspect of the lithium industry, including exploration, mining, and production of lithium. Get Global X Lithium & Battery Tech ETF (LIT:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. To achieve its investment objective, The Index is designed to provide exposure to the performance of global, publicly listed companies engaged in the mining. Global X Lithium ETF (the Fund) seeks to provide investment results that correspond generally to the price and yield performance of the Solactive Global Lithium. Learn about ETFs that provide investments in top lithium and battery technology for the electric vehicle industry. Find the latest quotes for Global X Lithium & Battery Tech ETF (LIT) as well as ETF details, charts and news at mercedes-models.ru Sprott Lithium Miners Fund (NASDAQ: LITP) seeks to provide investment results that, before fees and expenses, correspond generally to the total return.

Get Global X Lithium & Battery Tech ETF (LIT:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. Sprott Lithium Miners ETF (Nasdaq: LITP) seeks to provide investment results that, before fees and expenses, correspond generally to the total return. View Top Holdings and Key Holding Information for Ishares Lithium Miners And Producers ETF (ILIT) ETF Summary. The fund generally will invest at least 80% of. Find here information about the Global X Lithium ETF (LIT). Assess the LIT stock price quote today as well as the premarket and after hours trading prices. What. The iShares Lithium Miners and Producers ETF (the “Fund”) seeks to track the investment results of an index composed of U.S. and non-U.S. equities of companies. Top 2 Mutual Funds with LIT / Global X Funds - Global X Lithium & Battery Tech ETF ; , NP, WEIZX - Weiss Alternative Balanced Risk Fund Investor Class. No. of ), as amended) and as an alternative investment fund manager with “top up” permissions which enable the firm to carry out certain additional. Growing Global Opportunity: The lithium-ion battery market is expected to Amplify Investments LLC is the Investment Adviser to the Fund, and Toroso. Investment style risk: The chance that returns from the types of stocks in which the fund invests will trail returns from the overall stock market. Small-, mid-. U.S. Office of Energy Efficiency & Renewable Energy. (, February 1). Celebrating Another Breakthrough in Domestic Lithium Production. Investing involves. The fund invests at least 80% of its total assets in the securities of the underlying index and in American Depositary Receipts ("ADRs") and Global. The iShares Lithium Miners and Producers ETF (the “Fund”) seeks to track the investment results of an index composed of U.S. and non-U.S. equities of. The latest fund information for Global X Lithium & Battery Tech ETF, including fund prices, fund performance, ratings, analysis, asset allocation. The Fund seeks investment results that correspond to the EQM Lithium & Battery Technology Index, which provides exposure to global companies. IR Contacts. Investor Relations. Chris Lang [email protected] Transfer Agent. AST Trust Company Canada. LIT tracks a market-cap-weighted index of companies involved in the global mining and exploration of lithium, or in lithium battery production. While the. This example assumes that you invest $10, in the Fund for the time periods indicated and then sell all of your Shares at the end of those periods. Find the latest quotes for Global X Lithium & Battery Tech ETF (LIT) as well as ETF details, charts and news at mercedes-models.ru Why Invest in ION? · Global demand for lithium-ion batteries is rapidly rising. · Significant mining of lithium, nickel and cobalt is critical in order to meet. Income Investment Trust and the Aurora Investment Trust. The Fund (or the Company), currently intends to invest primarily in BESS Projects using lithium.

Paystub Explained

Your electronic pay statement, also called EStub, is available on NYCAPS Employee Self Service (ESS) in the Pay and Tax Information / View My Last Pay Stub. A pay stub is a document that breaks down an employee's total pay, showing gross income, deductions, and net income. Amount of money you receive in your paycheck after taxes and other deductions are taken out; also called take-home pay. Money taken out of your paycheck. Does the definition of compensation include stock-based compensation (i.e., stock grants, option grants, option exercises. This is the nontaxable portion of the allowance. These are contributions that were made after tax, meaning members have already paid tax on these contributions. Learn what some common abbreviations mean. Oftentimes, your employer, or the payroll company they have hired, will make use of abbreviations on your paycheck. Items marked with an asterisk(*) are taxable to the employee and are imputed as income. Current and year-to-date totals are listed by description of the. The requirements for depositing, as explained in Publication 15, vary based on your business and the amount you withhold. Federal tax deposits must be made. Typical elements of a paystub include: Pay information: date of pay period, check number; Employee information: your name, address, company department. Your electronic pay statement, also called EStub, is available on NYCAPS Employee Self Service (ESS) in the Pay and Tax Information / View My Last Pay Stub. A pay stub is a document that breaks down an employee's total pay, showing gross income, deductions, and net income. Amount of money you receive in your paycheck after taxes and other deductions are taken out; also called take-home pay. Money taken out of your paycheck. Does the definition of compensation include stock-based compensation (i.e., stock grants, option grants, option exercises. This is the nontaxable portion of the allowance. These are contributions that were made after tax, meaning members have already paid tax on these contributions. Learn what some common abbreviations mean. Oftentimes, your employer, or the payroll company they have hired, will make use of abbreviations on your paycheck. Items marked with an asterisk(*) are taxable to the employee and are imputed as income. Current and year-to-date totals are listed by description of the. The requirements for depositing, as explained in Publication 15, vary based on your business and the amount you withhold. Federal tax deposits must be made. Typical elements of a paystub include: Pay information: date of pay period, check number; Employee information: your name, address, company department.

7. 8 i i i. 6. 5. NOTE: Each circle is a link to a corresponding definition for that section. To use: Click on the character in each circle. Jane Smith. Learn about what information is required on a pay stub. Examine various pay stub laws and requirements and how often paycheck stubs are provided to. EHRI. Ref #. Name. Definition. Data Concept. Data Type. Record Identifier. Priority Notes. 1. Record Action. Indicates action to take with a data. This payroll provides for the contractor to show on the face of the payroll Enter in the Exception column the craft, and enter in the Explanation column. Below is an example of a Cornell paper pay stub. Each box is marked with a number, and each number has a corresponding explanation in the Pay Stub Details below. A wage type is a coding system used to define a type of payment or deduction on a pay statement. Wage type abbreviations (eight character limit) are itemized. Employers must withhold the income tax of the employees receiving "wages" as defined in Section (a) of the Internal Revenue Code. Electronic Filing and. Understanding Your Paycheck. Picture of a paycheck. picture of payroll check stub. As an employee, your paycheck and paycheck statement should look. This section displays the legend for deductions, letting you know the taxability. Section Pay Stub. This section displays your net pay information. If this. Paystub and Conclusion For more information on filling out W4 Your paystub EXPLAINED! K views · 1 year ago more. The Tax Geek. Pay stub (definition). A pay stub is a document that's given to an employee each payday. It shows their total amount earned, less deductions for things like tax. A pay stub is simply a record of a person's earnings, while a paycheque is the actual payment of the amount they're owed. Here are two ways teens might get paid. Since pay stub requirements vary by state, we've compiled a list of pay stub requirements for employers in all 50 states. For many teenagers, their first job brings their first paycheck, and the terms and the amounts on the pay stub are not always easy to understand. Income tax and. These are general abbreviations that are used on almost any paystub. They are fundamental parts of a paycheck stub and familiarizing them, particularly when. In this case, the paystub is a payment advice that details a direct deposit transaction. You may also see this term used when you receive a reimbursement by. 76 REMARKS: This area is used to provide you with general notices from varying levels of command, as well as the literal explanation of starts, stops, and. Take a look at these common check stub items and their descriptions to make sure you fully understand your pay and deductions. LE staff categories are defined in 3 FAM b. Payroll deductions are those mandatory and voluntary items that are reductions from the gross pay of an. Along with your pay, your employer must give you a pay stub. Your pay stub understand and interpret the meaning of written words. That's important for.

Capital Gains Taxes On Cryptocurrency

It depends on your specific circumstances, but you'll pay anywhere between 10 - 37% tax on short-term gains and income from crypto, or 0% to 20% in tax on long-. Arkansas. Nontaxable. In Arkansas, cryptocurrencies such as Bitcoin are not subject to tax. California. Cash Equivalent. California treats virtual currencies. Meanwhile, long-term Capital Gains Tax for crypto is lower for most taxpayers. You'll pay a 0%, 15%, or 20% tax rate depending on your taxable income. If you. How is the Income on Cryptocurrencies Taxed? Unlike stocks, bonds, and real estate, there is no income on cryptocurrencies; you only pay tax on it when it's. This number determines how much of your crypto profit is taxed at 10% or 20%. Our capital gains tax rates guide explains this in more detail. In your case where. Arkansas. Nontaxable. In Arkansas, cryptocurrencies such as Bitcoin are not subject to tax. California. Cash Equivalent. California treats virtual currencies. These gains are taxed at rates of 0%, 15%, or 20% (plus the NII for higher incomes). The exact rate depends on a few factors, but it's almost always lower than. Capital Gains Tax (CGT) Allowance: Profits from crypto transactions are subject to capital gains taxes. If your total taxable income is less than 44,$ . The tax rates for crypto gains are the same as capital gains taxes for stocks. Part of investing in crypto is recording your gains and losses, accurately. It depends on your specific circumstances, but you'll pay anywhere between 10 - 37% tax on short-term gains and income from crypto, or 0% to 20% in tax on long-. Arkansas. Nontaxable. In Arkansas, cryptocurrencies such as Bitcoin are not subject to tax. California. Cash Equivalent. California treats virtual currencies. Meanwhile, long-term Capital Gains Tax for crypto is lower for most taxpayers. You'll pay a 0%, 15%, or 20% tax rate depending on your taxable income. If you. How is the Income on Cryptocurrencies Taxed? Unlike stocks, bonds, and real estate, there is no income on cryptocurrencies; you only pay tax on it when it's. This number determines how much of your crypto profit is taxed at 10% or 20%. Our capital gains tax rates guide explains this in more detail. In your case where. Arkansas. Nontaxable. In Arkansas, cryptocurrencies such as Bitcoin are not subject to tax. California. Cash Equivalent. California treats virtual currencies. These gains are taxed at rates of 0%, 15%, or 20% (plus the NII for higher incomes). The exact rate depends on a few factors, but it's almost always lower than. Capital Gains Tax (CGT) Allowance: Profits from crypto transactions are subject to capital gains taxes. If your total taxable income is less than 44,$ . The tax rates for crypto gains are the same as capital gains taxes for stocks. Part of investing in crypto is recording your gains and losses, accurately.

General tax questions. Do I have to file a tax return if I don't owe capital gains tax? For the tax season, crypto can be taxed % depending on your crypto activity and personal tax situation. This means that, in HMRC's view, profits or gains from buying and selling cryptoassets are taxable. This page does not aim to explain how cryptoassets work. taxes on my crypto gains. I I left it at that, and have filed 3 years of crypto gains and losses, both capital and income since. Profits on the sale of assets held for less than one year are taxable at your usual tax rate. For the tax year, that's between 0% and 37%, depending on. Capital gains taxes apply only to capital assets, which include stocks, bonds, digital assets like cryptocurrencies and NFTs, jewelry, coin collections, and. How to file with crypto investment income ; 1. Enter your B information. Add the information from the B you received from your crypto exchange on. , explaining that virtual currency is treated as property for federal income tax purposes and providing examples of how longstanding tax principles. State capital gains are simply taxed at your ordinary income tax rate. This can range from 4% to % in New York, depending on your income bracket. This number determines how much of your crypto profit is taxed at 10% or 20%. Our capital gains tax rates guide explains this in more detail. In your case where. You sold your crypto for a profit. Positions held for a year or less are taxed as short-term capital gains. Positions held for over a year are taxed at lower. Short-Term Capital Gains Tax. Currently, the IRS views cryptocurrency as an asset and not cash. So, crypto gains from sales isn't seen as income but as a. These gains are typically taxed as ordinary income at a rate between 10% and 37% in Long-term capital gains and losses come from the sale of property that. What is the tax rate on cryptocurrency? · Ordinary income rates are between 10% and 37% depending on your income tax bracket. · Short-term capital gain rates are. You're required to pay tax on the profit you made from your sale (total sale price of your cryptocurrency minus original purchase price), commensurate with. The IRS treats cryptocurrencies as property, meaning sales are subject to capital gains tax rules. If the underlying cryptocurrency increases in value, you have capital gain income. If the underlying cryptocurrency falls in value, you have a capital loss. You. 1 Direct Tax Treatment of Crypto-Assets. The direct taxes are Corporation Tax ('CT'), Income Tax ('IT') and Capital Gains Tax ('CGT'). As with any other. On the other hand, if you hold your crypto for longer than one year, you will benefit from the federal long-term capital gains tax rate. In most instances, the. An on-chain crypto currency token, swapped for a different crypto currency token, is classified as disposing of an asset. And therefor, subject to capital.

Spreadbet Calculator

Sports betting odds are calculated with the main goal for sportsbooks being to receive equal money on both sides of a bet. Find out more about how to spread bet and see more examples, or use our spread betting calculator to see how margin, profit and loss work. FAQs. These easy-to-use spread betting calculators can help you work out your bets on the stock market. Use it to work out what your potential return could be. Total Goals Spread Bet Calculator football. Spread betting calculator has been created to help explain spread betting interactively. The spread betting. No matter the outcome you would net $80 (Bonus bet wins = $ minus $ hedge bet = $80, hedge bet winds = $80). Most sports bettors aim to get bonus bet. A matched betting calculator is a bit different to a regular odds calculator as it will help you calculate how to place lay and back bets to unlock profit from. Spread betting size calculator — a free tool that lets you calculate the size of the bet in pounds per point to manage your risks accurately. Spread Betting Beginners free position Size calculator. This position size calculator takes the stress out of calculating a position size. PointsBet Spread Betting Calculator · Introduction. This spread betting calculator determines the impact of the maximum loss setting on payoffs for spread bets. Sports betting odds are calculated with the main goal for sportsbooks being to receive equal money on both sides of a bet. Find out more about how to spread bet and see more examples, or use our spread betting calculator to see how margin, profit and loss work. FAQs. These easy-to-use spread betting calculators can help you work out your bets on the stock market. Use it to work out what your potential return could be. Total Goals Spread Bet Calculator football. Spread betting calculator has been created to help explain spread betting interactively. The spread betting. No matter the outcome you would net $80 (Bonus bet wins = $ minus $ hedge bet = $80, hedge bet winds = $80). Most sports bettors aim to get bonus bet. A matched betting calculator is a bit different to a regular odds calculator as it will help you calculate how to place lay and back bets to unlock profit from. Spread betting size calculator — a free tool that lets you calculate the size of the bet in pounds per point to manage your risks accurately. Spread Betting Beginners free position Size calculator. This position size calculator takes the stress out of calculating a position size. PointsBet Spread Betting Calculator · Introduction. This spread betting calculator determines the impact of the maximum loss setting on payoffs for spread bets.

For example, if a team has odds of +, a successful $ bet would yield a $ profit. Conversely, if the odds are , a bettor would need to wager $ to. For example, a $ bet made at decimal odds of would return $ ($ x ): $ in profit and the original $ amount risked. A $ bet made at. How do you calculate spread betting? Sportsbooks set the points spread based on the implied probability of each team winning. The favorite is then given a. This betting calculator allows you to enter a market line and produce the corresponding price for an alternate spread or alternate total. This calculator can. Before making any bet, it helps to know what you're risking for the expected payout. Enter Your 'Bet Amount' - that's what you're risking, along with the. Kentucky Derby Betting Calculator. Churchill Downs, Race 12 - STAKES G1. Enter your bet amounts, select your horse, see your probable return by TwinSpires. Forex Spread Calculator is an important tool for traders to help manage their risks by calculating the percentage spread in a general forex trade. The bet calculator allows you to input your stake & odds in American formats to quickly calculate the payout for your bets. It places a hedge wager that pays more than can be lost on the original bet. If you select this option in the hedging calculator above, you'll see that no. Enter the stake you wagered on the original bet and the odds you received, and then enter the odds that are now offered on the alternative result. Click “. By using this tool you can try and calculate discrepancies between the odds a book offers on a moneyline bet and a spread bet that they offer. This is a popular. Our betting odds calculator is perfect for showing you how to calculate potential winnings for all types of sports bets. It indicates how much you'd win. Click on “Calculate.” The spread to moneyline conversion sports betting calculator will then tell you:“Fave Win” – the implied probability of the favorite. Margin Calculator. Our Margin Calculator will convert Odds into probability and tell you how much your bookmaker is charging you. Enter the Odds for your bet. American odds: Los Angeles Lakers + If you bet on the Los Angeles Lakers moneyline and they win, you would receive a profit of $ for every $ wagered. Bet Calculator. Our Bet Calculator allows you to automatically calculate the Payout for any given combination of Stake and Odds, including Multiples. Enter the. If you want to trade financial markets, you've come to the right place. We invented financial spread betting in , and today we offer spread bets and CFDs to. Our Spread Betting Calculator. Using our spread betting calculator is a real game changer. Essentially, it makes the complex simple! Just input the points. You input how much money you are willing to wager on one side, and we show you exactly how much you need to bet on the other. It doesn't matter whether you are. Make your sports betting experience easier with our arbitrage calculator, calculate how much you should stake on different bets to guarantee a profit!